The Elliott Wave Principle: Exploring Its Intricacies, Algorithmic Applications, and Trading Strategies

Delve deeper into the fascinating technical framework of the Elliott Wave Principle, its algorithmic applications, and practical trading strategies. Understand how collective optimism and pessimism...

ALGORITHMIC TRADING.

2/7/20244 min read

For decades, the Elliott Wave Principle has captivated traders and analysts, offering a glimpse into the rhythmic dance of market psychology. This article delves deeper into this fascinating technical framework, exploring its intricacies, algorithmic applications, and practical trading strategies.

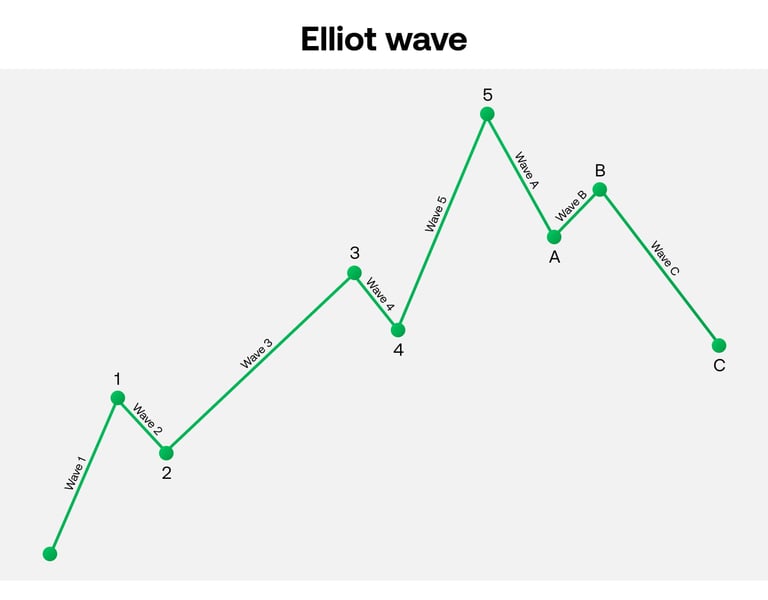

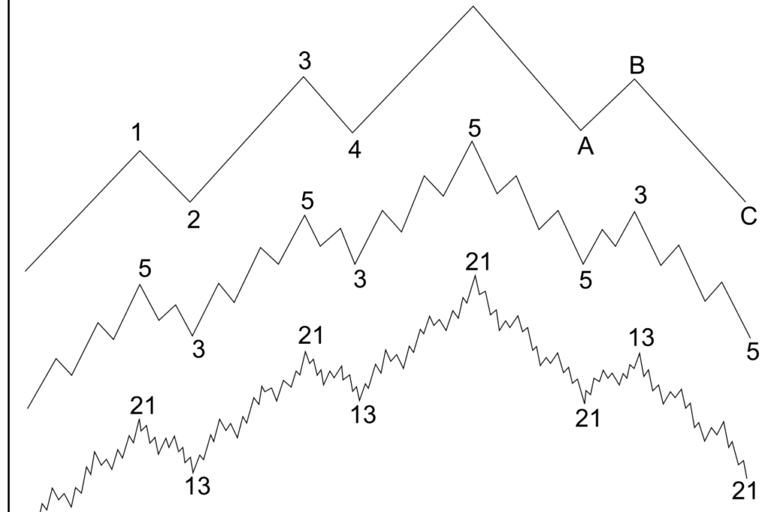

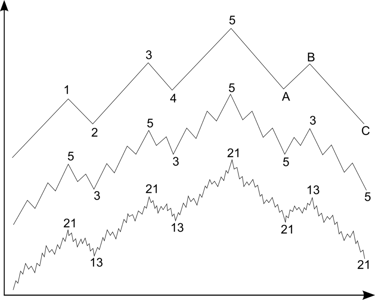

The Core Symphony: Motive & Corrective Waves

Imagine the financial markets as a vast orchestra, where collective optimism and pessimism play out in price movements. The Elliott Wave Principle proposes that these sentiments orchestrate predictable patterns of five motive waves (1, 3, 5), representing bullish surges, followed by three corrective waves (2, 4), acting as countertrends or retraces.

Delving into the Motive Melody:

Impulse Waves (1-5): The quintessential melody, comprising five sub-waves (a-b-c-d-e) within each wave. Think of this as the main theme, punctuated by corrective sub-movements.

Extension Waves (1-5-X): Imagine a powerful crescendo. The extension wave extends wave 3 far beyond its typical length, amplifying the bullish sentiment.

Diagonal Waves (1-2-3-4-5): A maverick in the orchestra. Diagonals trend against the larger trend, potentially signaling an imminent reversal and a change in the market's tune.

The Corrective Counterpoint:

Zigzag (a-b-c): A sharp, three-wave counterpoint, retracing the preceding motive wave in a decisive manner. Imagine a brief interlude of bearish sentiment.

Flat (a-b-c-d-e): A complex, five-wave correction with limited price movement. Think of this as a plateau in the overall trend, offering a moment of consolidation.

Triangle (a-b-c-d-e): A symmetrical or expanding pattern, reflecting indecision and uncertainty before the next directional move. Imagine the orchestra tuning its instruments, preparing for a new melody.

Labeling the Score: The Elliott Wave Notation

Each wave within a larger pattern carries a unique label. Motive waves are numbered (1-5), while corrective waves are lettered (a-b-c), with sub-waves further denoted by lowercase letters. This notation acts as the musical score, allowing traders to identify and interpret the market's movements.

The Fibonacci Harmony: Aligning with Nature's Ratios

Fibonacci ratios, like the ubiquitous 0.618 and 1.618, resonate with the Elliott Wave framework. These naturally occurring proportions help pinpoint potential reversal points within waves, based on retracements and extensions. Think of this as harmonizing the market's movements with the underlying mathematical order of the universe.

Decoding the Chart: Bringing the Theory to Life

Matching labeled waves on a chart to their descriptions requires practice and a discerning eye. Fortunately, algorithmic tools can assist with pattern recognition and backtesting, automating some of the analysis. Imagine having a skilled conductor guiding you through the complex score of the market symphony.

Trading to the Rhythm: Riding the Momentum Waves

Waves 3 and 5 of motive waves often attract traders due to their strong directional bias and momentum. Entry, exit, and stop-loss points can be strategically identified based on wave patterns, Fibonacci retracements, and other technical indicators, allowing traders to ride the momentum of the market's melody.

Examples of Algorithmic Trading Models:

Adaptive Wave Oscillator: This indicator identifies potential wave boundaries based on price action and volume, aiding in wave recognition and trade timing.

Elliott Wave Autotrader: This automated system uses pattern recognition algorithms to identify specific wave formations and generate trade signals accordingly.

Fibonacci Retracement & Extension Levels: These levels, integrated into trading platforms, help pinpoint potential entry and exit points aligned with Fibonacci principles.

Famous Funds Embracing the Wave:

Real Vision: Founded by Raoul Pal, this hedge fund incorporates Elliott Wave analysis into its investment strategies, focusing on identifying major market trends.

Elliott Wave International: This research firm, led by Frost & Prechter, has been instrumental in popularizing the Elliott Wave Principle and provides educational resources and trading recommendations.

Man Group: This global investment firm uses a variety of quantitative strategies, including some based on Elliott Wave analysis, to manage its diverse portfolio.

Francisco F. De Troya

Algorithmic trading & derivatives professional.

Executive Chairman, Blockmas

How To Invest in a Portfolio of Trading Systems?

Almost all retail traders lose all their money in less than 90 days by applying discretionary trading strategies. Successful traders invest in a decorrelated portfolio of algorithmic trading systems. In this small ebook we dive into how to analyse trading systems, how to invest in them, and how to build a portfolio of institutional grade algorithms.

The Dark Side of Brokers, And How To Win Them.

Most CFD brokers and derivatives firms profit from their clients' losses by being their counterparties and do everything in their power to make them lose their funds as quickly as possible. In this small ebook, our founder, Francisco F. De Troya, who worked for 3 of the largest brokerage firms in the world, exposes how the industry works and how you can really get the best results in the financial markets with algorithmic trading.

Entity

Blockmas Algorithmic Defi Group LTD is a British entity with registration number 15330972 and located at 128 City Road, London, EC1V 2NX, in the United Kingdom. Blockmas™ is a registered trademark owned by Blockmas Algorithmic Defi Group Ltd -the exclusive entity with full legal authority to manage the Blockmas™ brand. Stop trading. Invest in Trading Systems, Trade Everything, and Algorithmic Trading For Everyone are registered trademarks. All the content in this website is fully copyrighted, and unless a written allowance from our side is issued, it is completely forbidden to distribute it.

Services

Blockmas is not offering investment management, investment advice, or financial intermediation services neither in OTC (Over-The-Counter) derivatives, ETDs (Exchange-Traded Derivatives) or blockchain assets (synthetic tokens or perpetual future contracts). We never manage or hold our client's funds. Instead, we connect our clients with highly regulated financial institutions under an IB agreement. We are exclusively a technology company. Our algorithmic investment solutions connect our clients to third-party PAMM/MAM accounts offered by third-party regulated brokers and other copytrading solutions. Client's funds are always under their control and investors copy the strategies of other traders or investment firms. If any questions, you can contact our Compliance Department at compliance@blockmas.com.

CFDs risk warning

CFDs Are Complex Instruments And Come With A High Risk Of Losing Money Rapidly Due To Leverage. 75% Of Retail Investor Accounts Lose Money When Trading CFDs With The Providers We Introduce. You Should Consider Whether You Understand How CFDs, FX Or Any Of Our Other Products Work And Whether You Can Afford To Take The High Risk Of Losing Your Money. Trading In The Products And Services Of Brokers May, Even If Made In Accordance With A Recommendation, Result In Losses As Well As Profits. Trading Risks Are Magnified By Leverage – Losses Can Exceed Your Deposits. Margin Calls May Be Made Quickly Or Frequently, Especially In Times Of High Volatility, And If You Cannot Meet Them, Your Positions May Be Closed Out And Any Shortfall Will Be Borne By You. Values May Fluctuate Significantly In Times Of High Volatility Or Market /Economic Uncertainty; Such Swings Are Even More Significant If Your Positions Are Leveraged And May Also Adversely Affect Your Position. Trade Only After You Have Acknowledged And Accepted The Risks. You Should Carefully Consider Whether Trading In Leveraged Products Is Appropriate For You Based On Your Financial Circumstances And Seek Independent Financial Consultation. If any questions, you can contact our Compliance Department at compliance@blockmas.com.

ETDs risk warning

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily "leveraged" A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

Jurisdictions warning

Blockmas, a technology company only offering introducing brokerage services, does not offer investment management, investment consulting, or other related financial services. Nevertheless, we do operate exclusively in the jurisdictions in which our introducing brokerage services are allowed, and we are in constant monitoring and contact with different regulatory authorities to ensure the compliance of our products. If any questions, you can contact our Compliance Department at compliance@blockmas.com.

Telegram Channel

Whatsapp us

Legal information

Reach out

+44 7488 818 081

contact@blockmas.com

copysystems@blockmas.com

dex@blockmas.com

compliance@blockmas.com